by Albert Meige | May 17, 2017 | INNOVATION

Start-up companies are extremely active at the frontier of applied science. Their origins are diverse, but the following scenarios are most common: Spin-off from a public research organization. Prior to the effective creation of a start-up company, the team is often...

by Jacques Knight | Mar 26, 2016 | INNOVATION

One reason to build a startup index is to get data out of it. At least, such a reason might seem plausible. With data, you can measure such things as the life expectancy of startups. Why not? But this means that your index needs a graveyard, that is to say, a place...

by Jacques Knight | Feb 24, 2016 | INNOVATION

Dans l’épisode précédent de cette série, j’ai examiné l’impact disruptif de l’index de startup AngelList. L’un des secteurs chamboulés par la boîte de Naval Ravikant est le capital risque: les fameux venture capitalists, ou VCs. Le défaut...

by Jacques Knight | Jan 29, 2016 | DIGITAL TRANSFORMATION

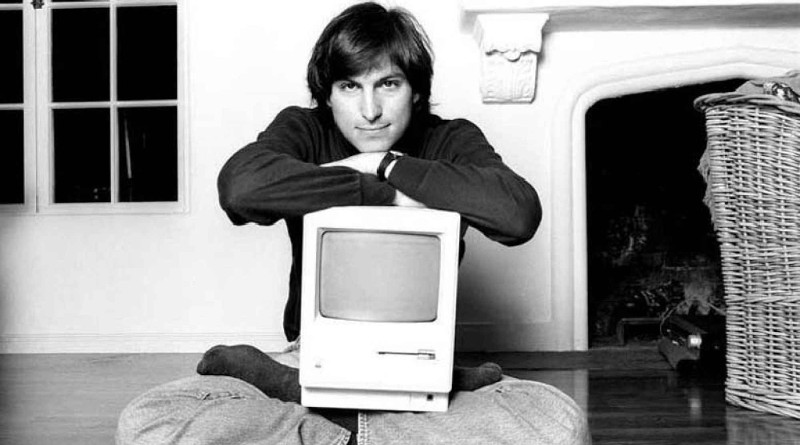

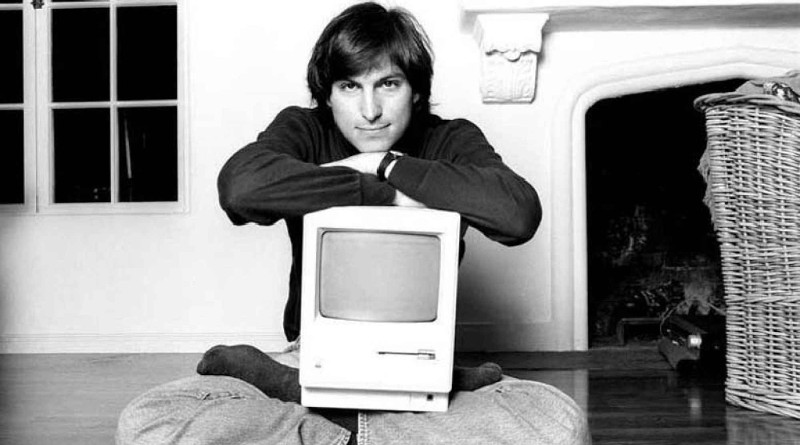

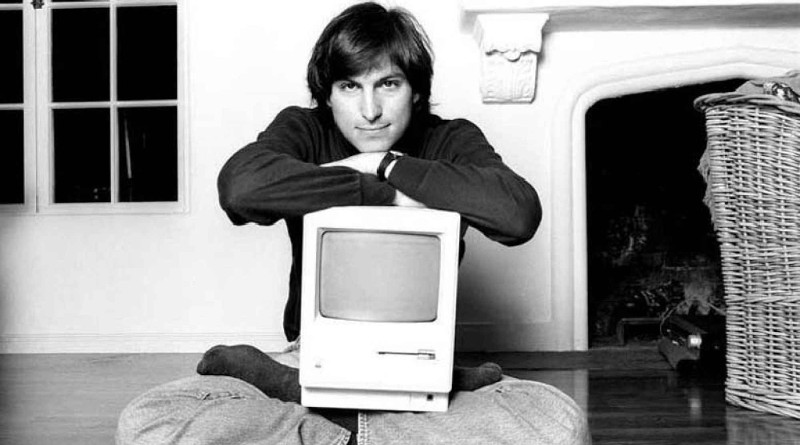

After reading this long article in the New Yorker about San Francisco, I found it impossible to avoid the conclusion that the way people work and live over there could just be the perfect exemplification of Innovation Intelligence. Innovation Intelligence is what...

by Jacques Knight | Nov 26, 2015 | INNOVATION

There are a lot of accelerators out there, and Presans has its eye on startup ecosystems. Earlier this month, the HEC Advanced Technology Group, the board of which Albert Meige is a member of, organized a conversation on the value proposition and business model of...